Federal Tax Standard Deduction 2024

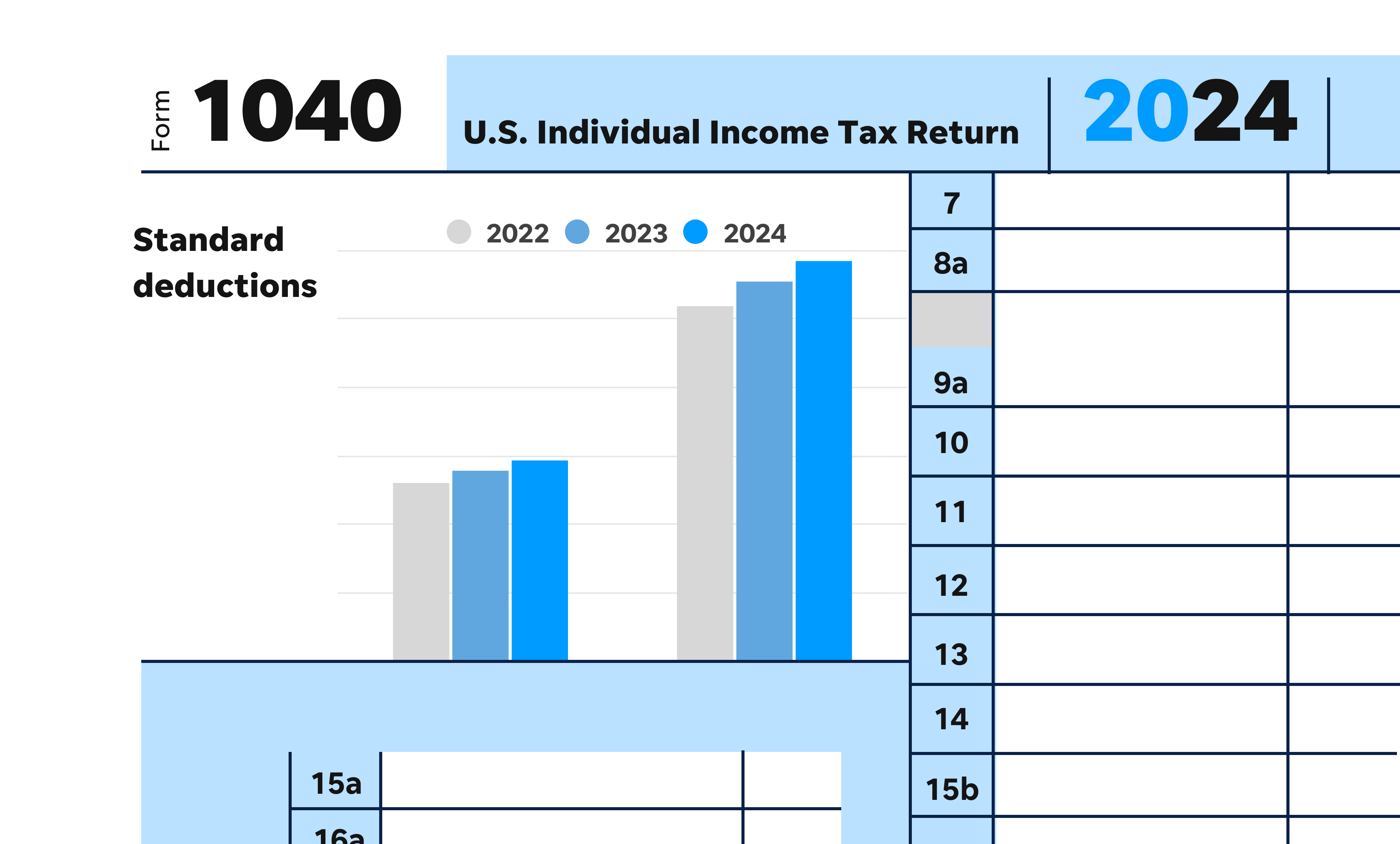

Federal Tax Standard Deduction 2024. The irs released the 2024 standard deduction amounts that you would use for returns normally filed in 2025. For single taxpayers and married individuals filing separately, the standard deduction will rise to $14,600 for 2024, up $750 from this year;

For 2024, such taxpayers generally get an. Turbotax deluxe 2023 tax software, federal tax return — $47.99 $59.99 (save $12).

(Returns Normally Filed In 2025) Standard Deduction Amounts Increased Between $750 And $1,500 From 2023.

But as dehaan points out, what makes this “essentially.

How Much Is The Standard Deduction For 2024?

$14,600 for married couples filing.

The Standard Deduction Rose In 2024.

Images References :

Source: www.ericvisser.nl

Source: www.ericvisser.nl

What is the standard federal tax deduction Ericvisser, How federal tax brackets work. The standard deduction rose in 2024.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, For taxpayers who are married and filing jointly, the standard deduction for the 2024 tax year was increased to $29,200, up $1,500 from 2023. Also, for 2024, it's predicted that the standard deduction for an individual who may be claimed as a dependent by another taxpayer will not be more than:

Source: lennaqevelina.pages.dev

Source: lennaqevelina.pages.dev

Federal Standard Deduction 2024 Audrye Jacqueline, 4, 2024 — tax credits and deductions change the amount of a person’s tax bill or refund. For 2024, such taxpayers generally get an.

Source: www.marketplacehomes.com

Source: www.marketplacehomes.com

New Standard Deductions for 2024 Taxes Marketplace Homes Press Release, How much is the standard deduction for 2024? How federal tax brackets work.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, People 65 or older may be eligible for a higher. Taxable income and filing status determine which federal tax.

Source: francenewmela.pages.dev

Source: francenewmela.pages.dev

What Tax Bracket Am I In 2024 Danna Elfreda, What is the standard deduction for 2024? For 2023 and 2024, most business meals are only 50% deductible, according to the current irs rules.

Source: www.contentcreatorscoalition.org

Source: www.contentcreatorscoalition.org

IRS Standard Deduction 2024 What is it and All You Need to Know about, Your guide to meal tax deduction for 2023 and 2024. The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2).

Source: www.msn.com

Source: www.msn.com

IRS announces new tax brackets for 2024. What does that mean for you?, The standard deduction rose in 2024. Here are the standard deduction amounts set by the irs:

Source: optimataxrelief.com

Source: optimataxrelief.com

2024 IRS Tax Brackets and Standard Deductions Optima Tax Relief, The standard deduction rose in 2024. How federal tax brackets work.

Source: cabinet.matttroy.net

Source: cabinet.matttroy.net

Federal Tax Withholding Tables For Employers Matttroy, The top 1 percent of taxpayers paid a 25.9 percent average rate, nearly eight times higher than the 3.3. Here are the standard deduction amounts set by the irs:

The Standard Deduction For The Tax Year 2024 Is $13,850.

But as dehaan points out, what makes this “essentially.

Taxpayers Who Are 65 Or Older, As Well As Those Who Are Blind, Generally Qualify For An Extra Boost To Their Standard Deductions.

How much is the standard deduction for 2024?