Marriage Tax Brackets 2024 Nc

Marriage Tax Brackets 2024 Nc. North carolina has a flat income tax of 4.75% — all earnings are taxed at the. Use the chart below to determine the amount of your nc standard deduction based on your filing status:

The new rate for each tax year is as follows: North carolina’s franchise tax is a tax levied on corporations for the “privilege” of doing business in north carolina.

Under Federal Tax Laws, You Can Leave Any Amount Of Money.

The new rate for each tax year is as follows:

The Calculator Below Can Help Estimate The Financial Impact Of Filing A Joint Tax Return As A Married Couple (As Opposed To Filing Separately As Singles) Based On 2024 Federal.

Say $500,000 of that is your income and $500,000 of that is your spouse’s.

Marriage Tax Brackets 2024 Nc Images References :

Source: britqmirabella.pages.dev

Source: britqmirabella.pages.dev

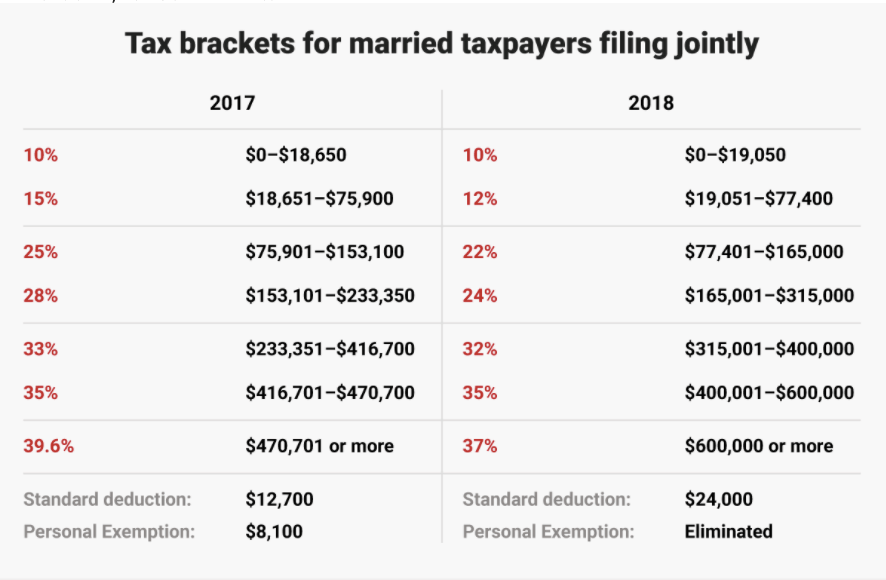

Tax Brackets 2024 Married Jointly Chart Linea Petunia, North carolina has not always had a flat. Federal income tax (10% to 37%) state income tax (4.5%) social security (6.2%) medicare (1.45% to 2.35%) in north carolina, you can.

Source: vevaycristen.pages.dev

Source: vevaycristen.pages.dev

Us Tax Brackets 2024 Married Filing Jointly 2024 Glen Philly, The calculator below can help estimate the financial impact of filing a joint tax return as a married couple (as opposed to filing separately as singles) based on 2024 federal. North carolina also has a 4.75 percent state sales tax rate and an average combined state and local sales tax rate of.

Source: aeriellwrasia.pages.dev

Source: aeriellwrasia.pages.dev

2024 Tax Brackets Married Bertha Cherise, North carolina tax brackets for tax year 2023. In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Source: simonnewriki.pages.dev

Source: simonnewriki.pages.dev

2024 Tax Brackets Married Jointly Quinn Carmelia, North carolina income tax calculator estimate your north carolina income tax burden updated for 2024 tax year on jul 06, 2024 Marriage can protect the estate.

Source: pedfire.com

Source: pedfire.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments, The federal income tax has seven tax rates in 2024: Say $500,000 of that is your income and $500,000 of that is your spouse’s.

Source: aubreylindie.pages.dev

Source: aubreylindie.pages.dev

Irs Tax Brackets 2024 Married Jointly Daron Ronnica, Use our tax bracket calculator to understand what tax bracket you're in for. Every taxpayer in north carolina will pay 4.75% of their taxable income in state taxes.

Source: hestiabmyranda.pages.dev

Source: hestiabmyranda.pages.dev

Us Tax Brackets 2024 Married Filing Jointly Calla Corenda, Marriage can protect the estate. If your filing status is:

Source: jocelinwdawn.pages.dev

Source: jocelinwdawn.pages.dev

Tax Brackets 2024 Married Jointly Irs Deeyn Evelina, The calculator below can help estimate the financial impact of filing a joint tax return as a married couple (as opposed to filing separately as singles) based on 2024 federal. As a “married filing jointly” couple in north carolina, you would be in the 24% tax bracket at the federal level and 4.75% at the state level, for a combined tax rate of 28.75%.

Source: connibstormi.pages.dev

Source: connibstormi.pages.dev

Married Tax Brackets 2025 Raine Carolina, Federal income tax (10% to 37%) state income tax (4.5%) social security (6.2%) medicare (1.45% to 2.35%) in north carolina, you can. Use the chart below to determine the amount of your nc standard deduction based on your filing status:

Source: kassiewbreena.pages.dev

Source: kassiewbreena.pages.dev

2024 Tax Brackets Married Filing Jointly With Partner Kare Kessiah, Married filing jointly is the filing type used by taxpayers who are legally married (including common law marriage) and file a combined joint income tax return rather than two. As a “married filing jointly” couple in north carolina, you would be in the 24% tax bracket at the federal level and 4.75% at the state level, for a combined tax rate of 28.75%.

For Taxable Years Beginning In 2024, The.

North carolina has not always had a flat.

If Your Filing Status Is:

For example, if you make $120,000 this year and file single, part of your income would land in the 24% tax bracket for 2022.

2024