Short Term Capital Gains Tax 2025 India

Short Term Capital Gains Tax 2025 India. The fund currently has an asset under management(aum) of ₹1,02,615 cr and the latest nav as of 18 aug 2025 is ₹10.00. 2) bill, 2025 and the subsequent proposed amendments received the assent of the president on 16 august 2025.

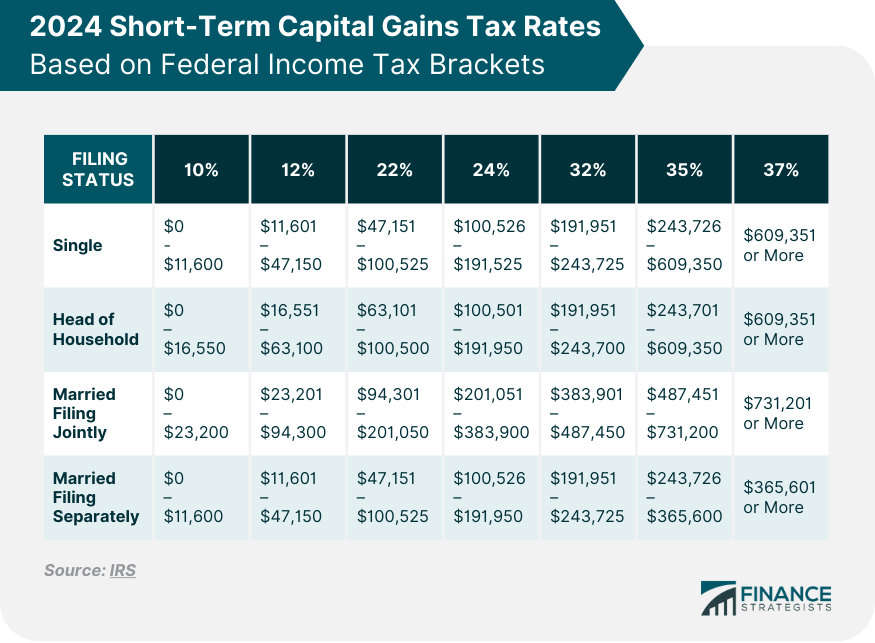

The long term capital gains (ltcg) tax will rise from 10% to 12.5%, and the short term capital gains (stcg) tax on certain assets will increase from 15% to 20%. This change will impact investments in equity, debt, gold, mutual funds, and property.

Short Term Capital Gains Tax 2025 India Images References :

Source: inezcallihan.pages.dev

Source: inezcallihan.pages.dev

Short Term Capital Gains Tax 2025 India Norah Theresa, Gains realized within two years will now be added to.

Source: theobriannon-margarethendren.pages.dev

Source: theobriannon-margarethendren.pages.dev

Capital Gains Tax Rate 2025 Stock Sale Price Glynda Wenonah, Imports of capital goods expanded by 11.6 per cent during june 2025, while capital goods production increased by 2.5 per cent in may 2025.

Source: lindaramey.pages.dev

Source: lindaramey.pages.dev

Long Term Capital Gains Tax Rate 2025 India Loria Robbin, What are the different types of capital gain tax?

.png?width=1920&height=1024&name=Short-Term_Capital_Gains_Tax_Rates_(2023).png) Source: caitlinmorgan.pages.dev

Source: caitlinmorgan.pages.dev

Capital Gains Tax Rates 2025 Irs Lanna Mirilla, The alterations announced in budget 2025 will affect all the assets you own.

Source: worksheetscamming.z13.web.core.windows.net

Source: worksheetscamming.z13.web.core.windows.net

Worksheet To Calculate Capital Gain Tax, What is a capital gain tax?

Source: ednafletcher.pages.dev

Source: ednafletcher.pages.dev

Capital Gains Tax Rates 2025 Ukraine Lynn Brandais, Budget 2025 has proposed to remove the benefit of indexation on the transfer of any capital asset on or after 23 rd july 2025.

Source: timmyamerson.pages.dev

Source: timmyamerson.pages.dev

Long Term Capital Gains Tax 2025 Calculator App Darcie Genovera, The franklin india ultra short duration fund direct growth is rated na risk.

Source: lorrainekaiser.pages.dev

Source: lorrainekaiser.pages.dev

Long Term Capital Gains Tax Rate 2025 Crypto In India Rica Morissa, What are the different types of capital gain tax?

Source: williamperry.pages.dev

Source: williamperry.pages.dev

Short Term Capital Gains Tax 2025 Chart Jewel Lurette, Understanding how it works, how to calculate and the strategies available to minimise it can help you make informed decisions about your investments and asset sales.

Source: joshuahutton.pages.dev

Source: joshuahutton.pages.dev

Long Capital Gains Tax Rate 2025 Vivia Joceline, Click here to connect with us on whatsapp.