Capital Gains Tax Rate 2024 House Sale 2024

Capital Gains Tax Rate 2024 House Sale 2024

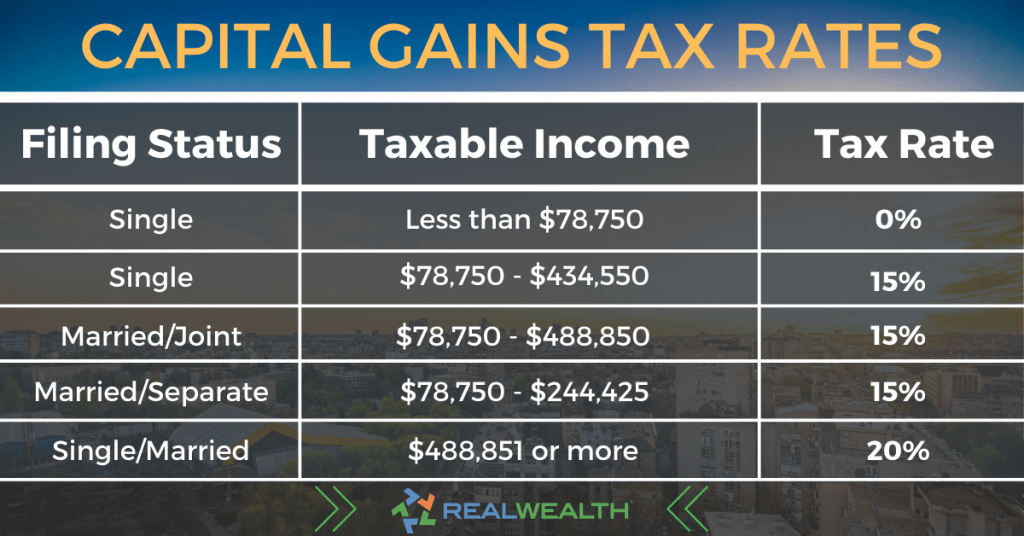

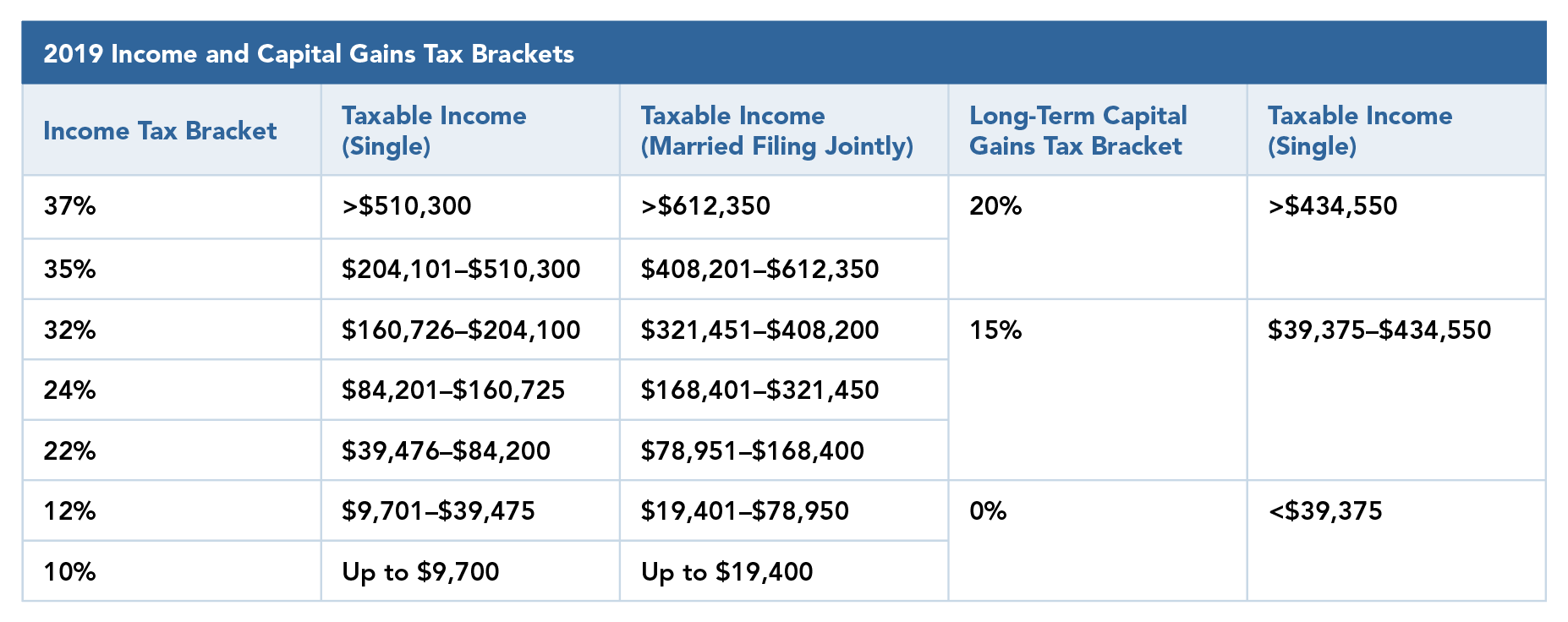

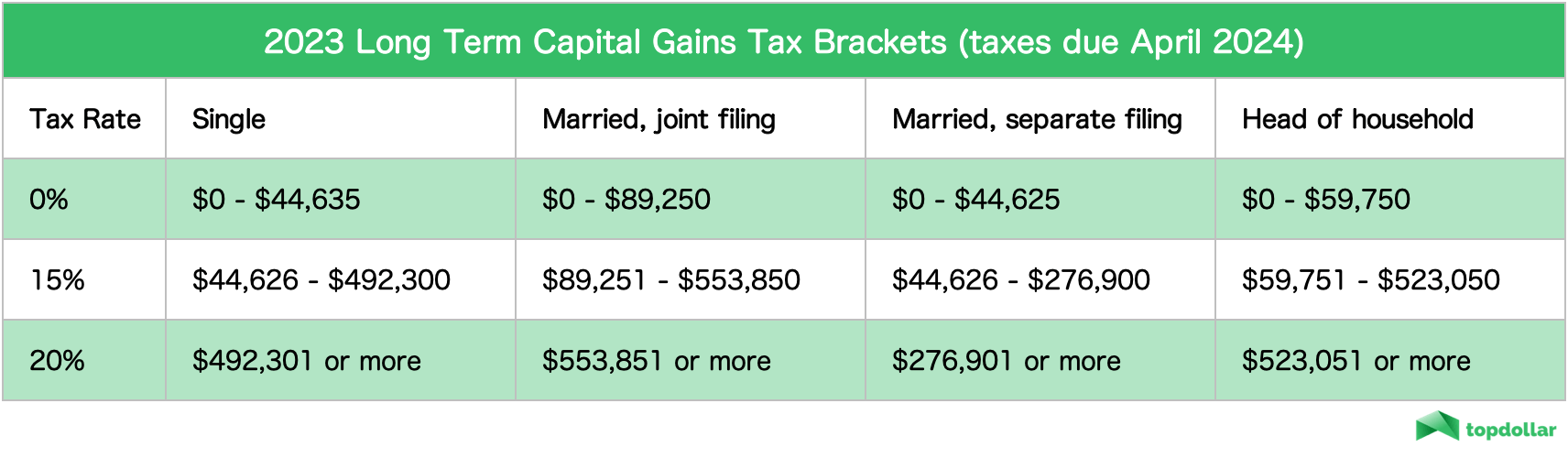

The rates are 0%, 15% or 20%, depending on your taxable. The capital gains tax rate for a capital gain depends on the type of asset, your taxable income, and how.

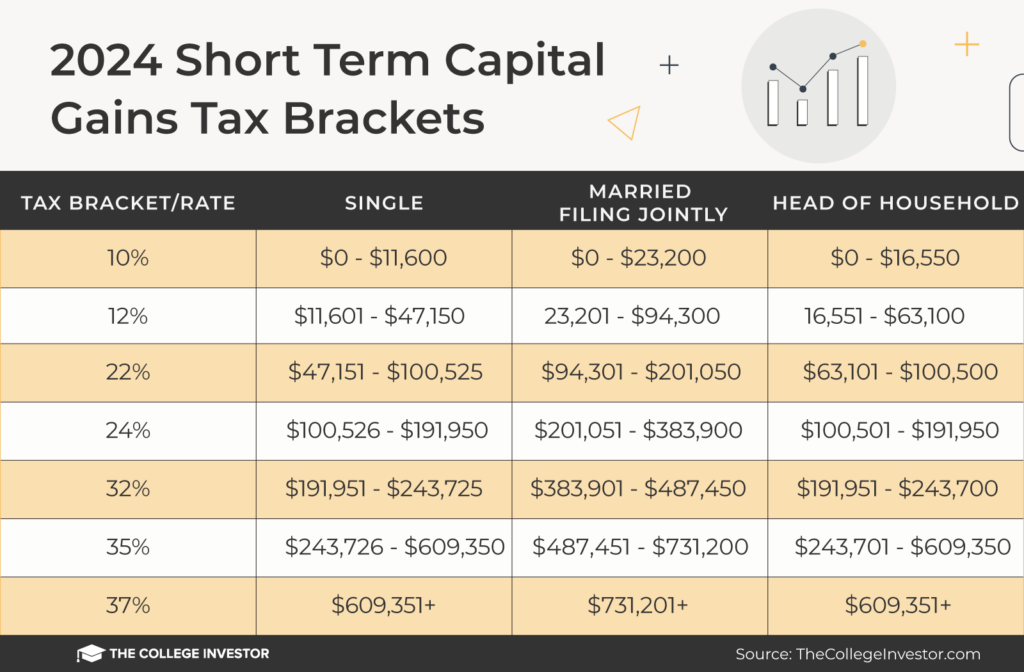

Here’s how this change could impact your real estate transactions:. For the 2024 tax year, you won’t pay any capital gains tax if your total taxable income is $47,025 or less.

Understanding The Nuances Of Capital Gains Tax Can Help You Minimize Your Tax Liability And Maximize Your Returns.

You will owe capital gains taxes on the net profit from the sale, but you will also owe gains on the cumulative depreciation benefits you have received while you.

This Guide Provides A Detailed Overview Of, What.

Here’s how this change could impact your real estate transactions:.

Images References :

Source: tiffyqdesdemona.pages.dev

Source: tiffyqdesdemona.pages.dev

What Is The Capital Gains Tax Rate In 2024 Tarah Francene, You will owe capital gains taxes on the net profit from the sale, but you will also owe gains on the cumulative depreciation benefits you have received while you. Scroll to the bottom for more info on ‘what are capital gains’ and/or view our.

Source: imagetou.com

Source: imagetou.com

Capital Gain Tax Calculator For Ay 2024 25 Image to u, 2024 capital gains tax strategies for home sales. The capital gains tax is a tax on any capital gains you make during a tax year.

Source: juanitawmiran.pages.dev

Source: juanitawmiran.pages.dev

Capital Gains Tax On Home Sale 2024 Wynny Karolina, The capital gains tax rate for a capital gain depends on the type of asset, your taxable income, and how. In simple terms, this capital gains tax exclusion enables homeowners who meet specific requirements to exclude up to $250,000 (or up to $500,000 for married.

Source: trudiqcathrine.pages.dev

Source: trudiqcathrine.pages.dev

2024 Capital Gains Tax Rates Alice Brandice, The capital gains taxation structure may be simplified by introducing a uniform holding period across domestic equities and mutual funds. For instance, the capital gains exclusion.

Source: fanyaqkarmen.pages.dev

Source: fanyaqkarmen.pages.dev

Tax Rate On Long Term Capital Gains 2024 Kaile Marilee, The federal government has proposed an increase in the “inclusion rate” from 50% to 66.67% on capital gains above $250,000 for individuals. This is a simple update on the capital gains tax rates for 2024, particularly in the sale of real estate.

Source: jenaqshelba.pages.dev

Source: jenaqshelba.pages.dev

Tax Bracket Chart For 2024 Jami Rickie, The capital gains tax is a tax on any capital gains you make during a tax year. Here’s how this change could impact your real estate transactions:.

Source: trudiqcathrine.pages.dev

Source: trudiqcathrine.pages.dev

2024 Capital Gains Tax Rates Alice Brandice, Industry hopes for capital gains tax relief from centre capital gains taxes can range from 10 per cent to as high as 30 per cent, depending on the. The federal government has proposed an increase in the “inclusion rate” from 50% to 66.67% on capital gains above $250,000 for individuals.

Source: www.pinterest.com

Source: www.pinterest.com

Capital Gains Tax Brackets for Home Sellers What’s Your Rate, We've got all the 2023 and 2024 capital gains tax. If you sold the house for $912,000, your capital gain could be $306,000, which would be well below the $500,000 exemption you could take if you sell the house.

Source: talyahwcarola.pages.dev

Source: talyahwcarola.pages.dev

Nys Capital Gains Tax Rate 2024 Helli Krystal, You will owe capital gains taxes on the net profit from the sale, but you will also owe gains on the cumulative depreciation benefits you have received while you. 2024 capital gains tax strategies for home sales.

Source: www.finansdirekt24.se

Source: www.finansdirekt24.se

ShortTerm And LongTerm Capital Gains Tax Rates By, Industry hopes for capital gains tax relief from centre capital gains taxes can range from 10 per cent to as high as 30 per cent, depending on the. The capital gains tax is a tax on any capital gains you make during a tax year.

Capital Gains Tax May Not Be The Most Exciting Part Of Selling Your Home, But It’s Important To Know How It’ll Impact Your Sale.

You will owe capital gains taxes on the net profit from the sale, but you will also owe gains on the cumulative depreciation benefits you have received while you.

The Rates Are 0%, 15% Or 20%, Depending On Your Taxable.

For 2024, the irs announced some rule changes on capital gains.